Eligible Criteria and how to get a Solar Rebate in Victoria

To be eligible, you must be an owner-occupier (or an eligible rental provider) with a combined household taxable income below $210,000 and a property valued under $3 million. The property must not have previously received a Solar Homes PV or battery rebate, and the system must be installed by an approved Solar Victoria retailer using accredited installers and approved products.

Table of Contents

How to get a Solar Rebate in Victoria

The Australian solar rebate and STC process is simple when handled correctly. Here’s how it works, step by step:

- Choose a CEC-Accredited Installer

Select a Clean Energy Council–accredited installer to ensure system safety, regulatory compliance, and full rebate eligibility. - Receive a Tailored System Design & Quote

Your installer assesses your energy usage and designs a system with a transparent, itemised quote that suits your home and budget. - Apply for STCs

STCs are typically claimed by your installer on your behalf for an upfront discount, though self-claiming is also an option. - System Installation & Compliance Checks

The system is professionally installed and inspected to meet all federal, state, and electrical safety standards. - STCs Created & Assigned

Once approved, STCs are created and transferred to the installer or relevant authority as part of the rebate process. - Receive Your Solar Rebate

The rebate is applied as a direct discount, significantly reducing upfront costs and accelerating your return on investment.

Following this structured process ensures a smooth, compliant, and financially rewarding solar installation.

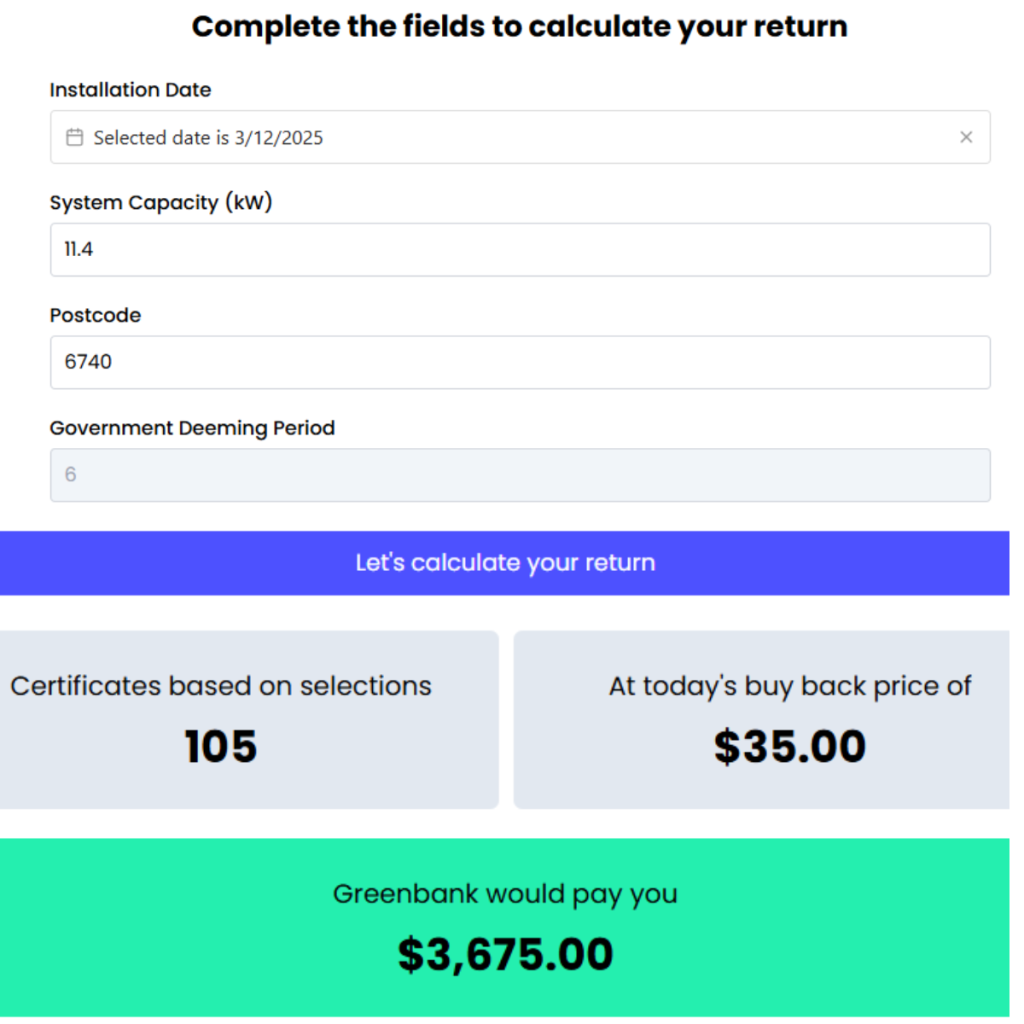

Calculating Your Solar Rebate

Understanding how your solar rebate is calculated is key to maximizing savings. The rebate is primarily based on Small-scale Technology Certificates (STCs), which represent the renewable energy your system will generate over a set period. STC value depends on factors such as system size, installation location, and installation date, meaning larger systems or installations in high-sunlight regions typically yield higher rebates. For example, an 11.4 kW rooftop solar system in Point Cook, Victoria, installed in 2025 might generate around 46 STCs, translating to $3,675 in upfront savings, with 1 STC = $35. Knowing these calculations helps homeowners plan budgets accurately, optimize system size, and take full advantage of government incentives. A clear understanding ensures your solar investment is financially smart and maximally efficient.

Tips to Maximise Your Solar Savings

To get the most from solar rebates and STCs in Australia, strategic planning is essential. Timing your installation can significantly impact STC value, as certificates decrease each year under the government’s declining scheme. Combining federal and state incentives—such as feed-in tariffs or regional rebates—further reduces upfront costs and accelerates ROI (return on investment). Maintaining your system is equally important: regular panel cleaning, inverter checks, and monitoring performance ensure maximum efficiency and long-term savings. Choosing a reputable, CEC-accredited installer and properly sizing your system also prevents costly mistakes. By following these expert tips, homeowners and businesses can enjoy optimized financial benefits, higher energy yields, and a smooth, hassle-free solar experience.

Green Electric Solutions (Altona Base), Victoria

Green Electric Solutions makes accessing solar rebates and STCs in Australia seamless for homeowners and businesses. By offering CEC-accredited installation, tailored system design, and STC handling, they simplify the entire process, reduce upfront costs, and maximize long-term savings. With expert guidance on federal and state incentives, system maintenance, and energy optimization, Green Electric Solutions ensures your solar investment is efficient, compliant, and financially rewarding from day one.

Understanding STCs (Small-scale Technology Certificates)

Small-scale Technology Certificates (STCs) are a core part of Australia’s solar incentive program, designed to make solar more affordable for homeowners and businesses. STCs represent a portion of the renewable energy your system generates, and each certificate can be traded or assigned to your installer to reduce upfront costs significantly. By lowering the initial investment, STCs accelerate your return on solar installation, making clean energy financially accessible.

The government determines STC value based on system size, location, and installation date, ensuring incentives are fair and targeted. Understanding how STCs work helps you claim maximum benefits, stay compliant, and plan your solar investment smartly, transforming renewable energy adoption into a cost-effective, hassle-free process.

The Role of Your Solar Installer

A qualified solar installer plays a pivotal role in ensuring you successfully claim solar rebates and STCs in Australia. Experienced installers handle all the paperwork, STC applications, and government compliance requirements, saving you time and avoiding errors that could delay your rebate. Choosing a Clean Energy Council (CEC)-accredited installer is crucial, as only accredited professionals meet the safety and quality standards required for rebate eligibility. They also provide accurate system sizing, design, and installation guidance, ensuring your solar system performs optimally. To avoid mistakes and delays, always verify accreditation, check references, and confirm STC handling procedures upfront. With the right installer, your solar project becomes hassle-free, fully compliant, and financially efficient, maximizing your savings from day one.

Frequently Asked Questions (FAQs)

Q: Do I have to claim the STC myself?

A: No. Most CEC-accredited installers handle all STC paperwork and transfer certificates directly, making the process simple and hassle-free.

Q: Can I sell my STCs separately?

A: While possible, most homeowners assign STCs to their installer to receive immediate upfront discounts, streamlining the process.

Q: Are rebates available for rental properties or commercial buildings?

A: Yes. As long as the system meets eligibility criteria and is installed by an accredited professional, both rental and commercial properties can access rebates.

Q: Why is understanding these points important?

A: Clear guidance helps avoid mistakes, stay compliant, and maximize financial benefits, ensuring a smooth, cost-effective solar installation.

Conclusion: Eligible Criteria To Get Solar Rebate in Victoria, Australia

Claiming solar rebates and STCs in Australia is simple when you follow the step-by-step process: choose a CEC-accredited installer, design your system, apply for STCs, complete installation, and receive your rebate. Act now to take full advantage of declining incentives. Use this quick checklist: verify eligibility, confirm installer accreditation, review system design, and track STC submission—ensuring you maximize savings and enjoy a smooth, cost-effective solar installation.

Recent Solar Projects

- Sigenergy 25kW Solar System & Rebates in Dingley Village VIC 3172!

- 11kW Solar System with 48kWh Battery in Attwood, Victoria

- 13kW Solar with 40kWh Battery Setup in Doreen, Victoria

- 17kW Solar with 19kWh Battery Installation in Strathtulloh

- 11kW solar with 40kWh battery installation in Cranbourne, VIC

- 13kW Solar and 42kWh Battery Installation in Donnybrook, Victoria

- 15kW Solar with 48kWh Battery Setup in Maribyrnong

- 8.55kW Solar System & 38.4kWh Battery Backup in Werribee

- Tarneit Homeowner Secures $20765 in Solar & Battery Rebates

- 11kW Solar & Battery System in Rockbank

- Wyndham Vale Home Secures $12,378 with 11kW Solar and 25kWh Battery